Bad UI has resulted in existential threats of a missile scare, anti-democratic design, and some of the most fun you’ll have on a webpage. But traditional fintech especially seems to struggle with creating a decent UI, despite handling the financial doings of multi-billionaire dollar entices. The latest debacle resulted in Citibank accidentally paying their loans on time. All $900 million of them.

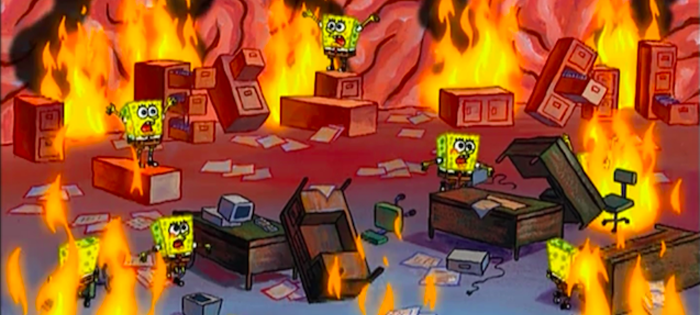

Being referred to as “one of the biggest blunders in banking history,” Citibank mistakenly wired roughly $900 million dollars instead of the intended $8 million to lenders of their client, Revlon, a makeup company experiencing a COVID-19 related 40% decrease in value. How does something like that happen? Well, let’s take a look at the UI:

Is that clear to you?

Despite its appearance, Flexcube, a piece of software from the Oracle Banking Suite, was not developed in 1995… It’s from 2012 and handles transactions like this every single day.

This wasn’t merely the misstep of a single individual, as two additional employees of the subcontracting firm okayed the wire, and then a final signature was required from a Citibank senior official in Delaware. The official’s words were, “Looks good, please proceed. Principal is going to wash.”

These are the experts who are supposed to understand the intentional obfuscation of the finance world. If these sorts of things can happen under the watch of senior industry professionals, human error and bad design is a concoction waiting to harm the individual (if not already).

So what could be done?

“Usable” doesn’t actually mean usable

First, just because a function can be performed, doesn’t mean the design is actually usable. For example, could you cut an over-cooked steak with a spoon? Sure, eventually. But since serrated knives exist, you’d hardly call a spoon useful for the task. Similarly, although Flexcube is capable of performing the intended task, the design is dated and, evidently, dangerous.

One thought that could have prevented this is to assume that professionals can make errors, and when you’re dealing with billions of dollars, why not expect it and prepare? A confirmation screen displaying the amount about to be moved could be something simple to try. Maybe a smart tooltip to describe each field (which might be insulting to senior officials like the one who signed $900 million away). We’re just brainstorming, here.

But there is a reliable way to decide on what to do. Test your usability.

Save yourself $500 million – start a free usability testing trial

Despite some of the lenders taking pity on the bank and wiring back the amount, District Judge Furman of NYC ruled that legally, they don’t have to.

“To believe that Citibank, one of the most sophisticated financial institutions in the world, had made a mistake that had never happened before, to the tune of nearly $1 billion — would have been borderline irrational,” the judge was quoted in the New York court document.

This means the remaining $500 million might not come back at all. How can you avoid this mistake?

Usability testing with Trymata

With only some bias, Trymata is usability testing and much more. The hallmark of good UX research is the user’s view – their opinion, both written and verbal, will offer you the actionable data you need most. Trymata’s usability testing suite is the “ah ha!” generating platform built for teams of all sizes and scope.

Unlike our competitors, Trymata is flexible, transparent, and comes with the quantitative metrics others in the UX industry just don’t offer. From our comprehensive yet intuitive dashboard, to the indexing and collaborative aspects of the narrated videos, Trymata is the one-stop shop for all things digital.

Read about our impression testing and see how much insight you could be getting on your digital products, designs, or marketing materials! Would impression testing Flexcube have saved Citibank $900 million and Oracle’s reputation? Probably.

Do more: Testing with your own testers (such as banking execs?)